Adani SEBI clean chit restores market confidence as India’s securities regulator dismisses all allegations against Gautam Adani’s conglomerate

Published: September 19, 2025

Adani SEBI Clean Chit Vindicates Business Empire

The Securities and Exchange Board of India (SEBI) has delivered a comprehensive clean chit to the Adani Group, dismissing all allegations raised in the infamous Hindenburg Research report. This Adani SEBI clean chit comes after an extensive investigation spanning nearly two years, where India’s capital markets regulator found no evidence of stock manipulation, insider trading, or violations of public shareholding norms against Gautam Adani’s business empire.

The regulatory verdict represents a significant vindication for the Adani Group, which has faced intense scrutiny since Hindenburg Research published its damaging report in January 2023. The Adani SEBI clean chit conclusion found that the allegations were “not substantiated” and that fund transfers between group companies did not violate any existing regulations.

In two separate detailed orders, SEBI clarified that entities like Milestone and Rehvar, despite having business ties with Adani companies, were not legally defined as related parties under the regulations in force at the time. The regulator also stated that retrospective application of amended definitions was “legally untenable.”

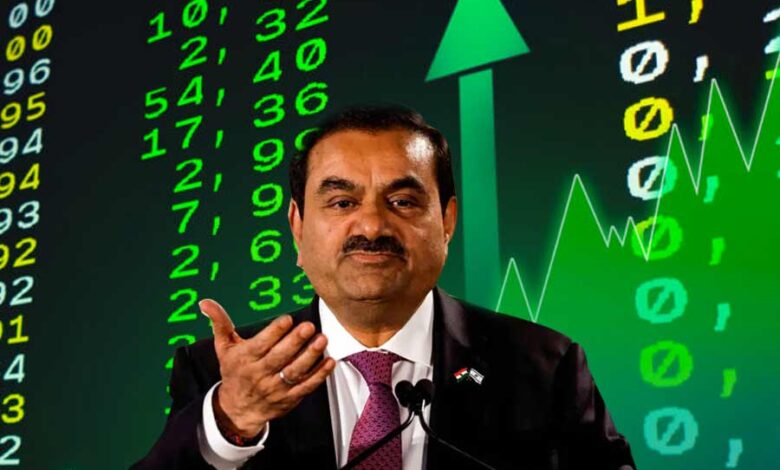

Adani Stock Rally Reflects Market Optimism

Following the Adani SEBI clean chit announcement, Adani Group stocks experienced a dramatic surge across all major exchanges including the BSE (Bombay Stock Exchange) and NSE (National Stock Exchange). The market’s response was swift and substantial, with several group companies witnessing double-digit gains:

Key Stock Movements:

- Adani Total Gas led the rally, climbing over 13% during intraday trading

- Adani Power jumped 8.53% to hit a high of ₹684.70

- Adani Enterprises hit its 5% upper circuit limit at ₹2,521.35

- Adani Green Energy advanced 4.47% to ₹1,022.70

- Adani Ports also witnessed significant gains in morning trade

The stock rally was accompanied by heavy trading volumes, indicating renewed investor confidence in the conglomerate. Technical analysts suggest that Adani group stocks could potentially see gains of up to 32% based on current chart patterns and market sentiment, according to various financial research platforms and market analysis reports.

This surge comes as a relief for investors who had suffered losses following the initial Hindenburg report, which had wiped out over $100 billion in market value from Adani companies at its peak impact. The Adani SEBI clean chit has effectively restored investor confidence in the conglomerate.

Hindenburg Investigation Concludes Without Penalties

The completion of the Hindenburg investigation marks the end of a challenging chapter for the Adani Group. SEBI’s probe, which examined allegations of accounting irregularities, stock manipulation, and related party transactions, concluded without imposing any penalties or issuing directions to the group.

The investigation’s findings directly contradict Hindenburg Research’s claims, which alleged widespread fraud and financial irregularities within the Adani ecosystem. For detailed background on the original allegations, readers can refer to Reuters coverage and Bloomberg reports from early 2023. SEBI’s conclusion that these allegations were unsubstantiated provides regulatory closure to the controversy that has dominated Indian market discussions for nearly two years.

Interestingly, Hindenburg Research, the short-seller that initiated this controversy, recently announced its closure, adding another layer of irony to the regulatory vindication of Adani Group.

Gautam Adani Demands Apology

Responding to the Adani SEBI clean chit, Gautam Adani, Chairman of the Adani Group, expressed vindication while demanding accountability from those who spread what he termed “fraudulent” allegations. “SEBI has reaffirmed what we have always maintained, that the Hindenburg claims were baseless,” Adani stated.

The billionaire industrialist also expressed empathy for investors who suffered losses due to the report’s impact on stock prices. “We deeply feel the pain of the investors who lost money because of this fraudulent and motivated report,” he added, suggesting that the group may seek redress for reputational damage.

Market Impact and Future Outlook

The Adani SEBI clean chit has restored regulatory confidence in the Adani Group, though the road to complete recovery may still be long. While today’s stock surge represents a significant positive development, most Adani companies remain below their pre-Hindenburg report levels.

Year-to-Date Performance Context:

- Despite today’s rally, Adani Enterprises remains down nearly 19% year-to-date

- Other group companies have shown mixed performance throughout 2025

- The clean chit is expected to improve institutional investor sentiment

Financial analysts believe that the Adani SEBI clean chit removes a major overhang on Adani stocks and could attract foreign institutional investment that had been cautious due to the ongoing investigation. For current market analysis and investment perspectives, investors can consult resources like Morningstar and Value Research. The group’s various infrastructure and energy projects may now proceed with greater confidence from lenders and partners.

Regulatory Credibility and Market Stability

SEBI’s thorough investigation and subsequent clean chit enhance the credibility of India’s regulatory framework. The detailed examination of complex financial structures and related party transactions demonstrates the regulator’s capability to handle sophisticated allegations while maintaining market integrity.

The verdict also reinforces confidence in India’s corporate governance standards and regulatory oversight, which are crucial for maintaining the country’s position as an attractive destination for international investment. For more information on India’s regulatory framework, visit the Ministry of Corporate Affairs official website.

Conclusion

The Adani SEBI clean chit represents a watershed moment for the Adani Group, marking the end of nearly two years of regulatory uncertainty. With allegations of stock manipulation and financial irregularities now officially dismissed, the group can focus on its core business operations and expansion plans.

For the broader Indian market, this development demonstrates the robustness of regulatory processes and the importance of evidence-based conclusions over speculative allegations. Readers interested in understanding more about Indian capital markets can explore resources from the Reserve Bank of India and Financial Stability and Development Council. As Adani stocks continue their recovery trajectory, investors and market participants will closely monitor how the group leverages this regulatory vindication to rebuild market confidence and pursue its growth ambitions.

The dramatic stock rally following SEBI’s announcement suggests that the market had been eagerly awaiting regulatory closure on this matter. With the Hindenburg investigation now concluded, the Adani Group enters a new phase of operations with restored regulatory confidence and renewed investor optimism.

read more: भारत की सबसे बड़ी विंड टर्बाइन कंपनी Suzlon Energy में आई भारी गिरावट, क्या करें निवेशक?

read more: अमेरिकी ऑर्डर के दम पर दौड़ा ये Renewable Energy Stock, 6 महीने में दिया 60% का तगड़ा रिटर्न, आगे क्या है संकेत ?

read more: ₹1 लाख के 63 लाख रुपए बनाने वाले इस Solar Energy Stock पर आया बड़ा अपडेट! शेयरों में होगा धमाल, रखें नजर…